Every 2 to 3 years, Scottish legal firms can expect an inspection by The Law Society’s Financial Compliance Team of Inspectors. The following series of articles will provide tips on how to prepare and deal with these well.

1 Dealing with an inspection

2 Pre-inspection tips

3 Inspection tips

4 Post-inspection tips

PRE-INSPECTION TIPS

Being pro-active is key. Preparation is essential.

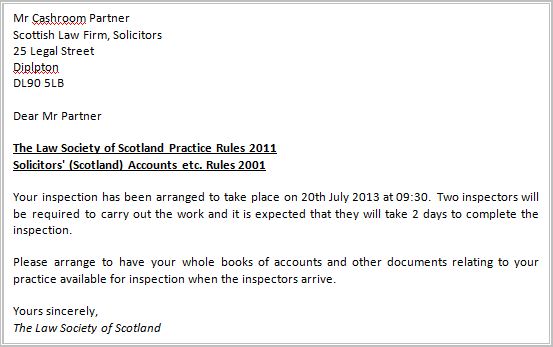

Preparation, does not start when you receive a letter from The Law Society to advise of your inspection – set aside time EACH MONTH to ensure your accounts procedures are up to scratch. Half an hour will do it, if you keep on top of matters.

What should you be checking? No doubt you will be aware of the extensive guidance The Law Society of Scotland produce, but the following are the main items for consideration from The Accounts Rules point of view.

Terms of Business

Perhaps the very first piece of correspondence with your client should be signed Terms of Business.

Have you read your style recently to ensure it is up-to-date?

Remind your client of their responsibility to keep you up-to-date with any address changes.

Specify how you will deal with any residual funds left over after a transaction is complete.

If your client keeps you advised of their current address, you will be able to deal with this easily.

Monthly Cashroom Reports

Bank reconciliations

Check all client account and all firm account (including savings accounts and loan accounts) reconciliation reports.

There should be a section entitled ‘Unpresented’ or ‘Uncleared’ or such-like. Do you understand why these items remain ‘unpresented’ past the month end? Cheques, for example, can take up to 6 months to clear from your bank but there should never be any credits or CHAPS or BACS or other bank transfers outwith the month they are posted which remain as ‘unpresented’.

Also, if there are any cheques more than 6 months old, these need to be dealt with by way of writing them back to the client or firm ledger they were originally posted to, and then dealt with accordingly.

List of client balances

Are headings correct for the ledgers? Pick a few files randomly to check this.

Peruse ALL client balances. Are there any ‘Suspense’ ledgers, or balances on ‘Holding’ ledgers? If so, ask to see a full ledger and ensure these are dealt with promptly.

Are there any large credit balances, if so – why do you still have funds for this client?

Get rid of any balances you have had for some time per the guidance on Small Credit balances. You should no longer retain balances for a transaction which cannot be shown to be ‘ongoing’.

Check debit balances – ask clients for a payment towards outlays where appropriate if the ledger will not ‘move’ for some time. Consider writing off very old debit balances, to reduce your monthly list.

DayBooks

Choose a selection of entries on your DayBooks – do they make sense?

Can you see any corrective entries, and do these make sense?

Ask to see copies of randomly picked ledgers – do the ledger entries match the daybook entries?

Interclient Transfers

Ask for a printout of your Inter-client transfer record.

Do you hold signed authority from your client for these transfers? (Such authority should specify the amount and be dated on or before your transfer.)

Trial Balance

Check that the Debit Column total matches the Credit column total.

Ask to see ledgers for a random selection of ledgers.

Balance sheet accounts will be ongoing balances for many years (banks, assets, liabilities).

Profit and Loss accounts should pertain to current financial year postings ONLY (income and expenses).

Check the ‘Balance per Ledger’ figure on your bank reconciliation reports – does this match the figure on your trial balance for the same account? If not, why not?

For any liability or loan accounts – do these balances match the ACTUAL balance outstanding? When were postings last made to these accounts? Do they need adjustments for interest accrued?

Returned Paid Cheques

Check that these are being returned.

Pick a random selection of cheques (include some that have been paid to a client, or a bank) to ensure that the cheque has been designated correctly (check from the ledger who the payee should be) – when paid to a bank, it should include the client’s name(s), and preferably also their account number.

Have there been any ‘adjustments’ to the cheque which have not been initialled by the signing partner?

Supplier Statements

It is good to randomly check statements from your suppliers – searchers, surveyors, property centres, etc – to ensure these are being paid promptly when possible.

Are there any invoices seriously overdue?

Ask to see client ledgers for any invoices due that you do not understand – make random spot checks to ensure funds are being dealt with timeously.

Quarterly Cashroom Reports

VAT Reports

Does the VAT figure due match your firm’s trial balance to the same date?

Check random entries on your VAT detail report for accuracy of VAT calculations. Check 20% of the net figure.

Is the VAT due being paid timeously?

Other Funds Reports

Ask to see a selection of bank statements from your other funds list. Does the balance per your ledger match the balance per the bank statement?

Are there any accounts which have been held for years, that can now be closed and distributed appropriately?

You must receive a bank statement quarterly, or have the bank update the passbooks quarterly. If this is not possible (for example, fixed term deposits where a statement is only produced at close of the account), seek guidance from The Law Society of Scotland’s Compliance Team. Generally, these accounts should be removed from your list of other funds and placed on the firm’s Securities register instead.

Powers of Attorney

Check your firm’s central list of Powers of Attorney and pick a random selection of files from that list.

If the Power is in favour of one of your solicitors, and they operate that account solely, ensure that this account is included in your ‘Other Funds’ list, and is being reconciled at least quarterly.

Bi-Annual Checks

Accounts Certificate

Take the opportunity twice a year to make random checks on systems and procedures.

If cash has been received, is this in accord with the firm’s ‘set limit’ of total cash acceptable per transaction?

Are client monies paid into the client bank promptly? Check the date of receipt of the letter with the date of the credit to the client ledger.

Review your register of rule breaches for this 6-month period. Do you need to adjust procedures to ensure future compliance?

Do your staff need training?

Do you think an external Cashroom Review would be helpful?

Annual Checks

Financial year-end

In the last month of your financial year, check your firm’s accounts to ensure any adjustments required are posted within the correct financial year – this will cut down on accountants adjustments required.

Compare the balances per your Trial Balance this year, to the same date last year. – Is there anything out of kilter? Can any large difference be easily explained?

Are all loan and hire purchase accounts recorded appropriately?

Are there very old unpaid fee notes to be written off?

Are there any suspense accounts?

This list is not exhaustive. The extent of checks required will depend on the size of your firm and the type of work you do. What I hope is clear – preparation and spot checks are necessary! If you don’t do them, The Law Society will.

FAIL TO PREPARE, PREPARE TO FAIL